Data Enrichment Is the Secret to Digital Banking & Customer Experience

Quick summary

-

Growth of digital and cashless payments is generating insights around consumer’s financial activities and spending behaviours.

-

Not all data enrichment is created equal. The better quality the data, the more granular your customer experience.

-

Without accurate and categorized data, personalisation suffers.

As financial services continue to shift towards programmed solutions and fintech applications, customer data will be the key to delivering an engaging digital experience.

Consumers want online access to their finances. A survey by Provident Banks stated that over 80% prefer digital banking channels than a physical bank. When it comes to meeting customers online expectations, personalisation is the way of the future. It is crucial that financial services create digital engagement that can meet customer demand.

For decades, the financial services industry has relied on external data points from credit scores to surveys to applications to better understand customers. But what if the most valuable data is data we already have?

What is Data Enrichment?

Banks collect an immense amount of customer data.

With the growth of digital and cashless payments, consumers are generating more and more data (and insights) in their bank statements around their financial activities and spending behaviours. While transaction data can be hugely valuable, raw transaction data is often illegible, misleading, and inaccurate – containing long strings of text or code that make much of the data in that form unusable or unreliable in identifying financial activities, until now.

- Banks collect an immense amount of customer data. Banks collect an immense amount of customer data.

- Quality data is the #1 ingredient in every data strategy.

- Data enrichment is a data intelligence process of converting unstructured

Data enrichment is a data intelligence process of converting unstructured, low quality data into high quality and usable information. For banks and financial services, the enrichment of transaction data is transformational. It translates “gobbledigook” into clear, understandable and workable data. At Finch, our enrichment APIs use machine learning to correctly classify transactions into categories and our proprietary database to provide further information and accuracy such as merchant name and location as a baseline. Quality data is the #1 ingredient in every data strategy.

Growth of digital and cashless payments is generating insights around consumer’s financial activities and spending behaviours

The Benefits Of Data Enrichment

Enriched transaction data is enormously valuable because it captures a customer’s daily interactions and behaviours. In the same manner websites collect information based on our browsing behaviour, transaction data allows us to collect information based on our financial behaviours.

Why is this so transformational?

- Transaction data presents factual information about our customers financial activities: income, expenses, how much they’ve saved, how much they’ve spent, debts, guilty pleasures, aspirations.

- It is transformational for the finance industry because it means, we no longer have to rely on surveys and applications, and third party data sources

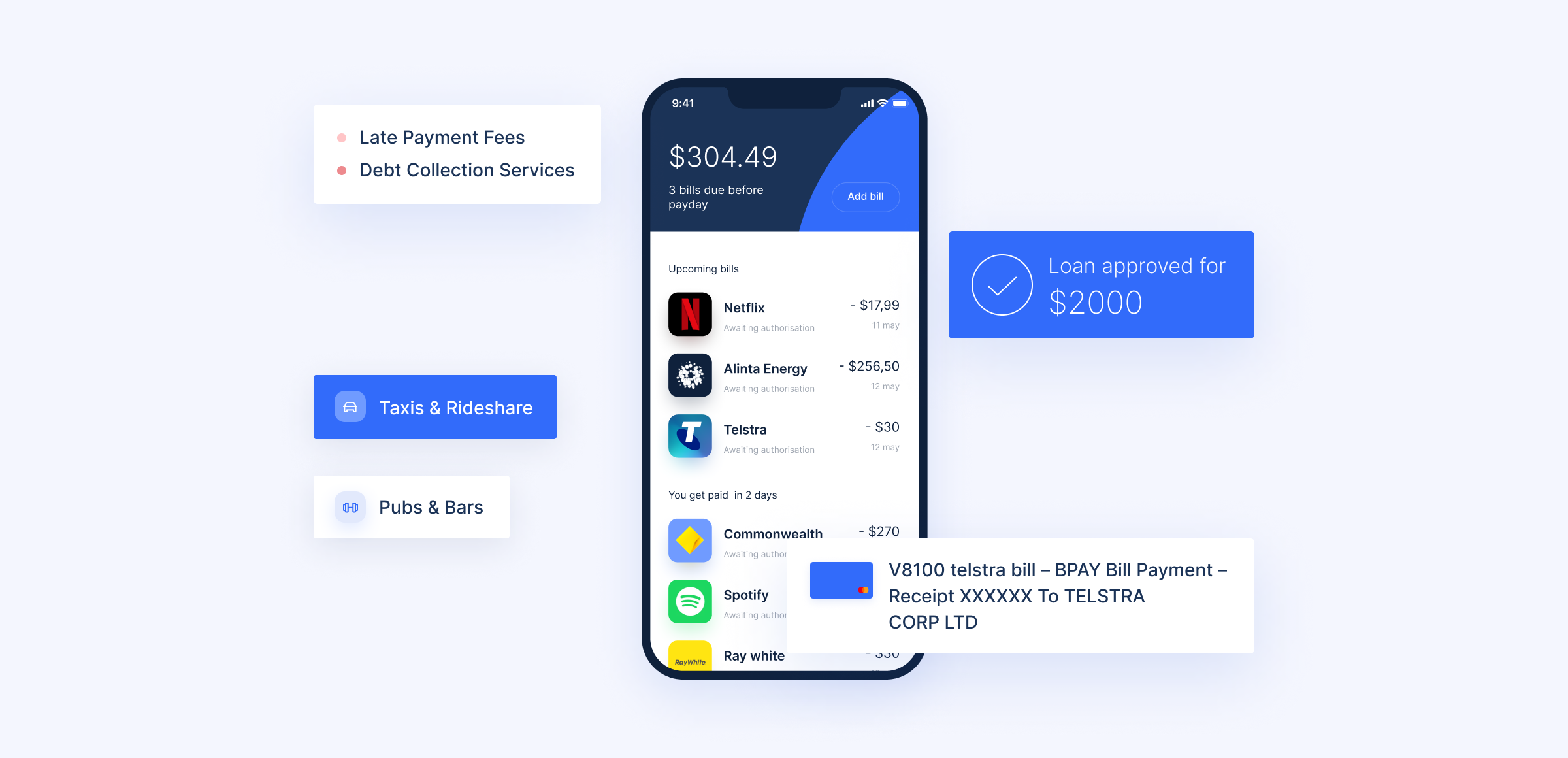

- Take personal finance apps for example. In order to help customers save on bars and entertainment the app would have to know that Fred Smith PTY LTD is in fact Jimmy’s Bar.

Or perhaps the PFM app is helping them save on fees. They would first need to be able to identify and differentiate between a bank fee, credit fee, or loan fee.

Outside of financial and fintech use cases, data enrichment can increase business transparency. Credit reports and forecasts all benefit from accurate representations of consumer trends. Legible and visualized data can help a financial service make clear choices that uphold its fiduciary responsibility.

Improving Digital Experiences with Data Enrichment

Even though transaction data could be of such high value, consumers still report their frustration with digital banking systems.

Financial services have lagged behind in offering helpful online experiences, and much of that still stems from low-quality transactional data. Without accurate and categorized data, personalization suffers. Accurate data analytics and intelligence are the foundation of engaging, highly differentiated digital user experiences, and without it, new service offerings, promotional campaigns, and loyalty programs will have far less effect in user acquisition and retention. Banks and Fintechs looking for a market advantage can use the opportunity digital data currently presents.

But not all data enrichment is created equal. The better quality the data, the more granular your customer experience.

FinchXP is a data intelligence Saas Platform, and it can transform transaction data into actionable customer insights. For more information on how Finch can help you get granular level metrics optimized for digital consumer engagement, click here.